In 2024 the Brazilian real depreciated by 25%, sovereign rates rose by nearly 550 basis points and the Ibovespa fell by 10% in local currency terms.

These returns would seem to represent a country in total crisis and a complete loss of the fiscal anchor. However, the reality is different: the country will grow close to 3.0% during 2024 and maintains an inflation that, despite its increases, has remained in the target range, below 5.0%. The institutional framework of the central bank has been strengthened, with the new president Gabriel Galipolo indicating that the independence of the central bank will be respected outside of any political pressure.

Despite the concerns of investors, especially local investors, people continue to go about their daily lives, while consumer and business expectations have not changed much. Given this context, could the negative movements be an overreaction and therefore an opportunity? What explains the sell-off in Brazilian markets?

Understanding fiscal dynamics in Brazil

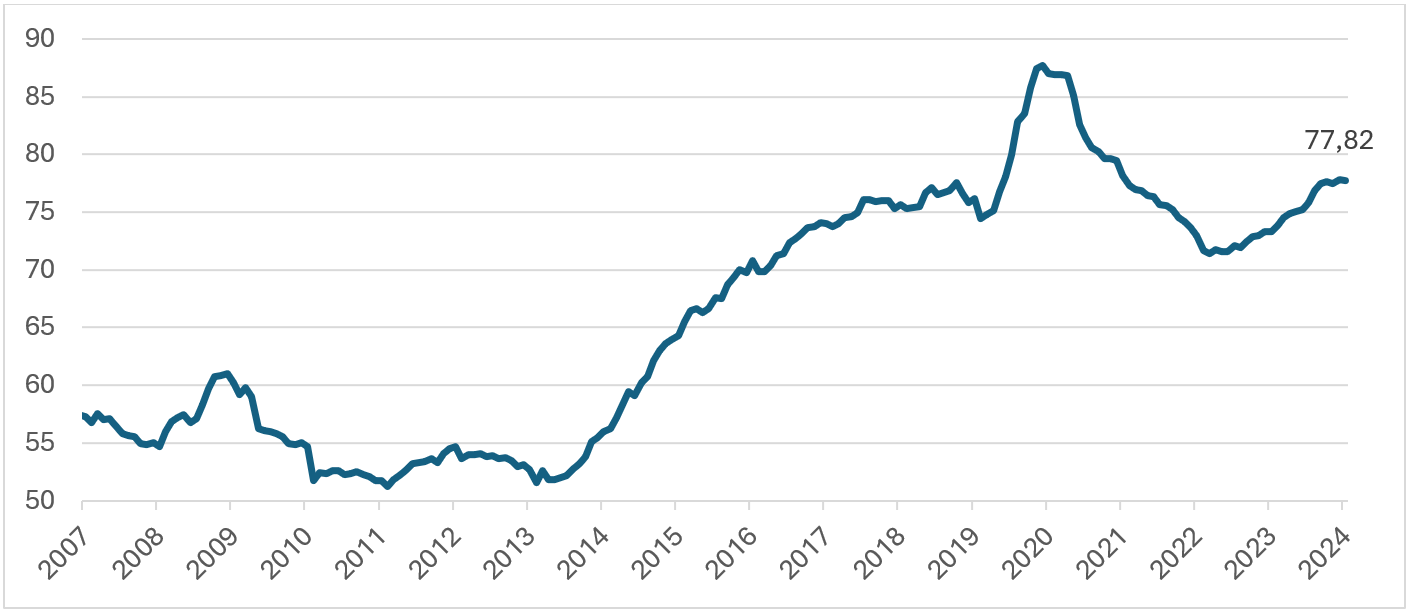

The immediate response is a deterioration of fiscal expectations in the face of disappointing signals from the Lula administration. Looking deeper into this, according to Brazilian finance ministry statistics, the gross debt ratio as a % of GDP has reached levels close to 80%, which has meant an increase of 30 percentage points in the last 10 years. This places Brazil as the country with the highest debt ratio in Latin America, followed by Mexico and Colombia. However, for the last three years, the debt has remained stable at around these levels.

Indeed, it should be noted that the speed of debt accumulation has not been faster than in other countries in the region and that there have been important institutional reforms to address this. In fact, as can be confirmed by the latest figures, accumulation declined from its peak in 2020 to around 70% by the end of 2022 (Chart 1).

Chart 1: Gross General Government Debt as percent of GDP

As background, the main debt boost was marked by the impeachment of Dilma Rousseff in 2016 and a short transition government led by Michel Temer. In this administration, advances were made in one of the most important reforms to limit fiscal spending, freezing it for 20 years, subject to inflation growth (called PEC 55), which was later made more flexible.

In the following administration, President Jair Bolsonaro pushed a strong reform agenda on the pension, labor and tax simplification fronts. The pension reform in 2019 succeeded in changing the processing of laws that made the system unsustainable, which would save about BRL 870 bn over the next decade, including changes in the retirement age, among other measures.

However, the COVID-19 pandemic imposed a strong pressure on the fiscal coffers, which added to the persistence of public expenditures caused a new impact on public finances, especially related to pension and education items.

Towards the end of Bolsonaro's term, the independence of the central bank was constitutionally established, preventing the country's president from arbitrarily changing the BCB governor. Instead, his mandate was established for 5 years, thus being decoupled from the political cycle.

Lula's return to power

As of January 1, 2023, President Luiz Inacio Lula da Silva began a new administration characterized by greater fiscal spending pressures in the face of more populist campaign promises. However, one of the reassuring points was the appointment of Fernando Haddad to the Ministry of Finance, which, despite his membership in the PT, was well known in Faria Lima's offices.

In his administration, for the first time since the redemocratization of Brazil (more than 30 years ago), a tax reform was approved, which advanced in the VAT tax simplification and promoted progressive taxation on inheritances, among other measures. Following its approval, the S&P agency upgraded the country's credit rating, also praising the improved growth prospects.

On another front, a new Fiscal Framework Law was introduced to replace the fiscal framework of the expenditure ceiling, with a focus on “collecting more”. Additionally, it limited fiscal spending growth to 70% of the previous year's tax revenue growth and established a band between 0.6% to 2.5% real for public spending growth.

Finally, Haddad was one of the strongest advocates of setting the Central Bank's inflation target at 3.0%, even challenging Lula's willingness to set it at around 4.0%. The administration even signed a decree freeing the government from setting an annual inflation target, thus shifting to a continuous inflation target, with the objective of providing a long-term fiscal horizon. The target will be effective from 2025, and the central bank will have to report quarterly on its compliance with it.

Certainly, it is clear that, in spite of being an administration described as populist at the beginning, important progress was made in fiscal and monetary institutionality.

What happened? Last developments and price action

At the beginning of 2024, the difficulty of collecting the tax revenues made it necessary for the government to readjust its objectives given by the new Fiscal Framework, establishing conditions that were stable enough to be accepted by the market.

Despite the rating confirmation from Moody's and S&P, the market was still pushing for more credible signals of fiscal convergence. Thus, Finance Minister Fernando Haddad began to negotiate a fiscal spending cut package that was intended to generate fiscal savings of around BRL 72 bn (~1% GDP).

However, at the time the fiscal consolidation plan was to be presented, it was leaked that it would also include a tax exemption proposal for those earning less than BRL 5,000. Although the proposal was planned to be fiscally neutral, analysts were not convinced by the idea of increasing the tax on the super-rich to compensate for the exemption, which would cost about BRL 30 bn. In simple terms, the market lost confidence because the government, instead of making a tax cut, presented a fiscal stimulus.

Thus began a strong sell-off that increased the Brazilian sovereign debt curve by more than 250 points, depreciated the BRL by close to 10% and had a contagion effect on the sovereign premium (CDS) and the Brazilian stock market. Returning to fiscal dynamics, real interest rates are at 7%, while GDP is growing by around 2-3%.

Recovering market confidence

The last few days have been key to recovering market confidence and mitigating some of the negative sentiment that has dominated the Brazilian market since late November.

On the one hand, the efforts of the BCB have been outstanding. Both the current governor Campos Neto and the next governor as of January, Gabriel Galipolo, have been emphatic in confirming the independence of the issuing entity and emphasizing that the central bank will continue to maintain its main objective of anchoring inflation expectations.

Thus, at the last meeting it raised the SELIC rate by 100 basis points to 12.25% and committed to future adjustments of the same magnitude. In addition, it remained very active in interventions in the foreign exchange market, enabling the BRL to recover practically all of its losses.

Meanwhile, the rapid passage of the fiscal package before the Christmas recess allowed sovereign bond rates to stabilize, falling by 100 basis points in just two days. Meanwhile, the currency has remained at around 6.15, significantly reducing its volatility, also considering the central bank's collaboration in successive interventions totaling close to USD 20 bn.

In conclusion, although structural measures are still needed to ensure fiscal convergence, it seems that the Brazilian authorities have understood the cost of generating wrong expectations to the market, which will force them to adopt a more rigorous approach in the face of a more challenging environment. In this context, it appears that much of the impact on markets is largely internalized and there is an important opportunity to watch macroeconomic developments in Brazil closely.

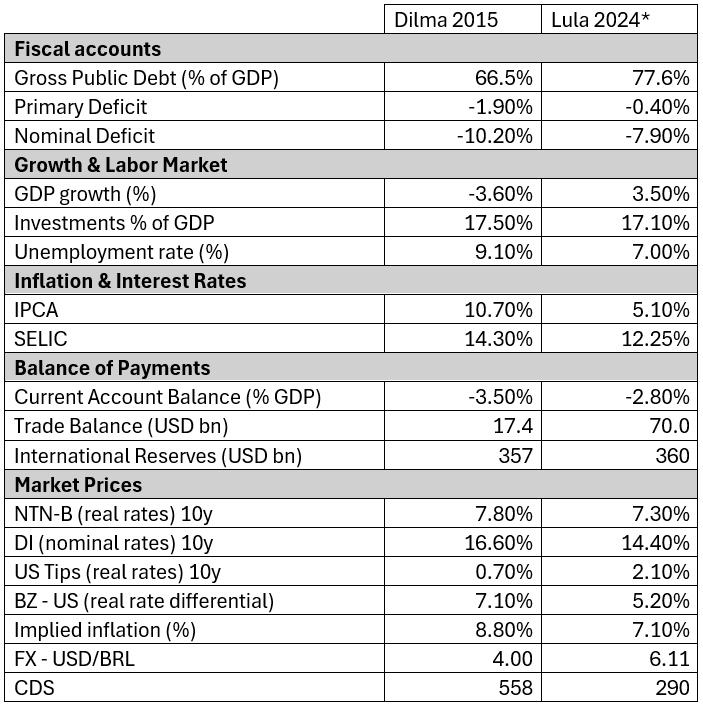

Additionally, as seen in Table 1, the situation considering reforms and macroeconomic statistics is better than in Dilma's government in 2015. Related to the above, some positive drivers would be related to a lower volatility of the BRL (which has occurred in recent days) and to the possibility that the center-right coalition nominates a strong candidate (e.g. Tarcísio de Freitas, governor of São Paulo) for the 2026 presidential elections, considering Lula's recent loss of popularity.

Table 1. Comparison Dilma 2015 and current situation (Lula 2024)

LarrainVial S.A. LarrainVial Chile. Isidora Goyenechea 2800, 15th Floor, Las Condes, Santiago, Chile.

Tel.: +562 2339 8500Teléfono: +562 2339 8500

All Rights Reserved ©Copyright 2025