This past Sunday, Bolivia held presidential and parliamentary elections. The outcome marked a resounding victory for right-wing forces and a historic collapse of the left, which had governed the country for the past 20 years. The presidential runoff will take place on October 19th. Among the most striking results was the massive loss of seats for the Movement for Socialism (MAS) related to parliamentary representation. Its leader and founder, Evo Morales, who served as president for 3 periods, is currently facing several criminal charges.

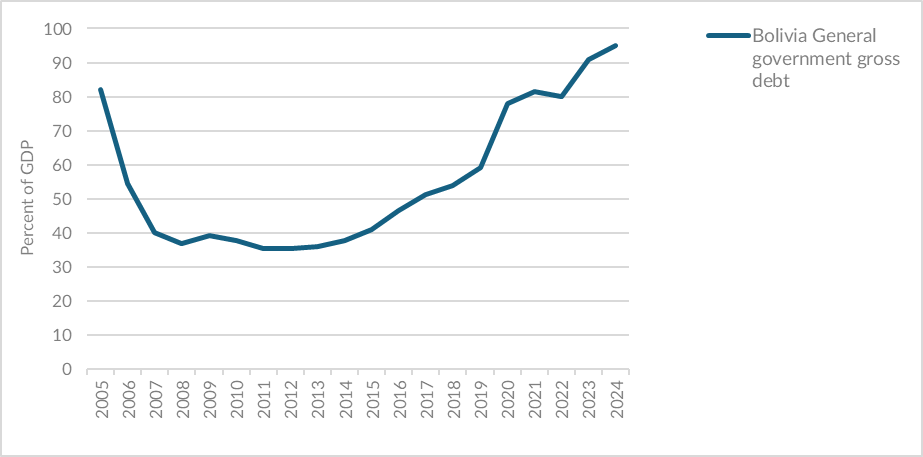

These elections took place in the backdrop of a severe economic crisis. A fixed exchange rate, combined with a fiscal deficit exceeding 10.7% of GDP and high public debt, that according to the IMF reached 95% of GDP, pushed inflation almost 25% annually, while shortages of basic goods, particularly fuel, intensified. Until recently, Bolivia had a private, individually capitalized pension system that helped foster an emerging local capital market. That framework collapsed when the government expropriated pension funds to address the growing fiscal deficit and the shortage of dollars.

In this sense, Sunday’s election represents an important moment for a country that, until now, had aligned itself with the Cuban-Venezuelan axis. Populism managed the unthinkable: in a nation with some of the largest hydrocarbon reserves in the region, fuel became scarce. Institutional decay was equally severe, with international reports documenting political persecution of opponents and systematic attacks on democratic institutions.

For Chile, the stakes are particularly high given our 900-kilometer shared border with a dysfunctional state. This has translated into unchecked human and drug trafficking, and the theft of vehicles in Chile later “legalized” and sold in Bolivia, causing heavy losses for the Chilean insurance industry. Yet perhaps the greatest cost of Bolivia’s decline is the lost opportunity to turn its commodities into wealth; gas, lithium, would be an important growth catalyst for the country of just 12 million people.

Bolivia’s election may signal broader political winds shifting across the continent, away from two decades of Chavista-Venezuelan-style ideology and toward more pragmatic economic policies. Something markets would welcome enthusiastically. Argentina’s recent turnaround provides a clear example, and even countries with less exposure have shown the way forward. In Ecuador, barely a year and a half after winning office, President Daniel Noboa has delivered notable improvements through similar policies. The performance of Ecuador’s sovereign bonds: a total return of more than 140% in the same period, a remarkable recovery demonstrating that with political will, obstacles can be overcome.

Looking ahead, this new wave of political change will be tested in upcoming elections across the region. In the short term, highly consequential votes are scheduled in Argentina, Chile, Colombia, and most importantly, given its size, Brazil. While the underlying conditions in these countries (with the notable exception of Argentina) are generally stronger than those of Bolivia or Ecuador, we firmly believe that political leadership with a more market friendly framework, typically associated in this region with right-wing governments, could provide a significant boost to markets.

Graph 1: Bolivia debt to GDP

Source: IMF DataMapper, April 2025

LarrainVial Asset Management

LarrainVial S.A. LarrainVial Chile. Isidora Goyenechea 2800, 15th Floor, Las Condes, Santiago, Chile.

Tel.: +562 2339 8500Teléfono: +562 2339 8500

All Rights Reserved ©Copyright 2025