Author: LarrainVial Asset Management / September, 2025

Ten years ago, banking in Brazil was a comfortable oligopoly. Transfers were clunky and expensive, with old transfer systems that shut down after business hours. Credit cards dominated electronic payments, but merchants had to wait weeks to receive funds unless they paid up for the costly “prepayment” service. Account penetration was improving, yet millions of Brazilians still operated largely in cash.

Fast-forward to today, the picture is entirely different. Banking accounts went from 85 million to over 200. System AUM more than tripled to 10 BRL trillion. According to the Central Bank data, cash usage in transactions fell from 76.6% in 2019 to just 40.5% in 2023. But what happened? In one word: digitalization. In essence, the perfect mix between digital banking and a surprising state-built instant payment system known as PIX.

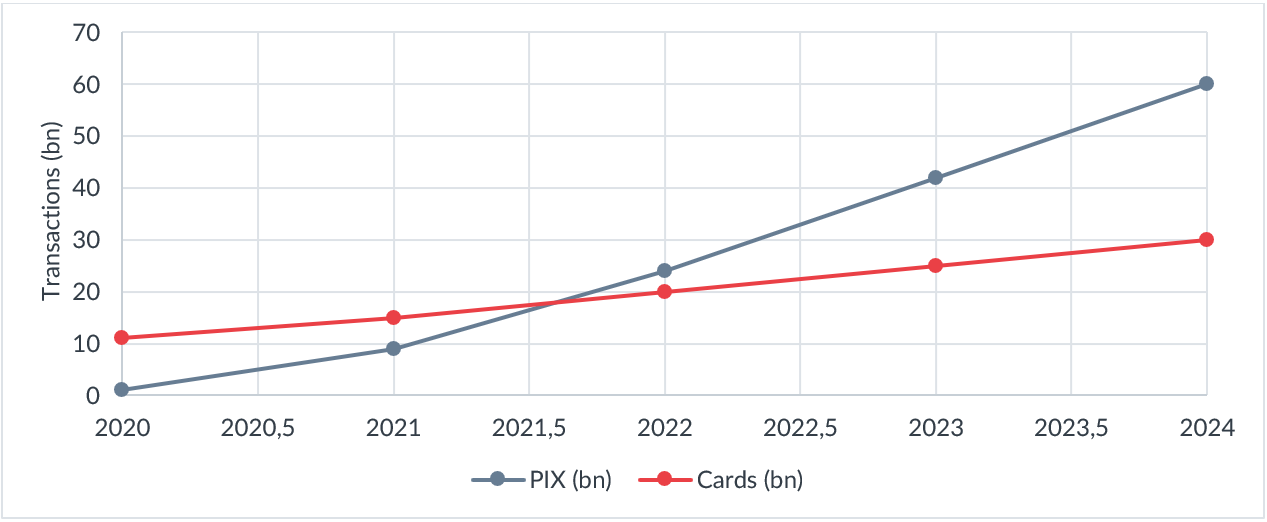

Launched in late 2020, PIX was available to anyone with a smartphone and a bank account. PIX was born as a Central Bank of Brazil initiative under Roberto Campos Neto’s leadership to modernize the country’s payment infrastructure. Crucially, the government acted as a strong sponsor: participation was mandatory for banks and fintechs, ensuring instant, 24/7 transfers at near-zero cost from day one. That public push made the difference: similar schemes elsewhere faltered because incumbents had little incentive to open the rails. In just a few years PIX overtook cards as Brazil’s most used payment method, with more than 150 million users and transactions settling in seconds at a fraction of traditional merchant fees (three to eight times cheaper). Today, its total payment volume stands at US$5 trillion—larger than Germany’s GDP. Some 93% of Brazilian adults have used PIX, and 62% say it is their most frequent payment method. In sheer scale, PIX now accounts for nearly half of all financial transactions in the country.

And PIX is far from done. Inspired in part by India’s UPI (Unified payment interface) that by mid-2025 carried 80% of that country’s digital payments, Brazil’s version has already completed its first phase: mass adoption. The next test is whether PIX can invade credit card territory with features like PIX Automático for recurrent and scheduled payments. Layered on top, Open Finance promises to supercharge lending by replacing thin bureau files with real transaction data. For incumbents, that means thinner margins, for digital natives or adopters, a unique opportunity.

Beyond consumer habits, PIX has rewritten corporate economics. Small merchants now get paid instantly when done through PIX, at virtually no cost, eliminating the cash-flow drag that once forced them into expensive financing. For banks and fintechs, the system generates a continuous stream of behavioral data, feeding better credit models and generating the opportunity of expanding lending to previously overlooked segments. Regulators have doubled down by making Open Finance the world’s broadest data-sharing framework, laying the groundwork for smarter credit, sharper risk pricing, and highly personalized financial products.

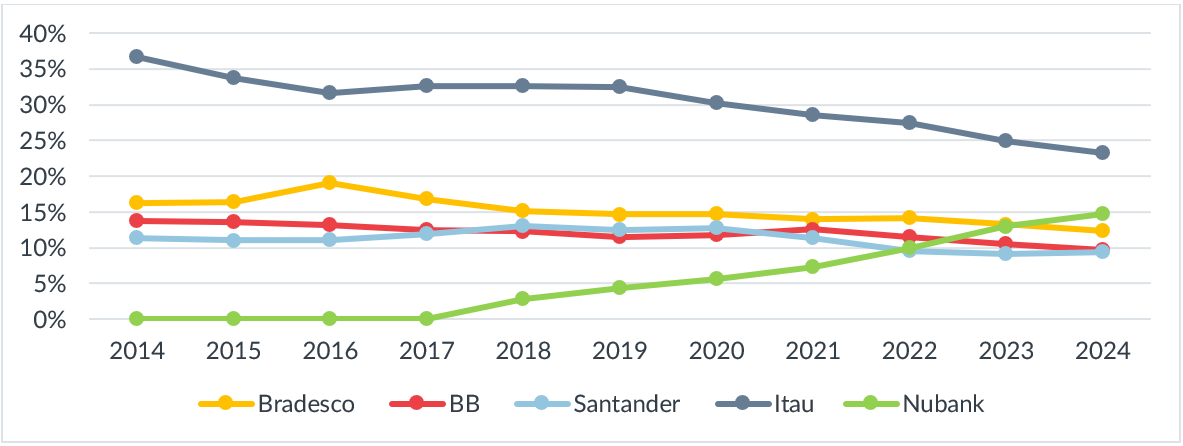

If PIX changed the rails, Nubank changed the train. The digital bank proved that Brazilians weren’t just ready for digital payments, they were ready for digital banking altogether. In twelve years, without a single physical branch, what began as the credit card of savvy millennials has turned into a mass-market bank. Today Nubank serves everyone from homemakers to retirees, making it one of the largest financial-inclusion platforms in the world. Nubank went from zero to 123 million clients, about 60% of Brazil’s adult population. Its cost to serve is just US$0.8 per client per month, less than 20% the cost of incumbents, showing how radically lean a digital model can be. And the connection between PIX and Nu is not to be overlooked: more than 25% of all PIX transactions go through Nubank. The symbolism grew even stronger this year when Roberto Campos Neto, the former Central Bank governor who championed PIX, joined Nubank as Vice Chairman and Global Head of Public Policy. And the story doesn’t stop at Brazil. In Mexico, Nubank already counts over 12 million clients, roughly 13% of Mexican adults and a quarter of the banked population. Recently, it earned approval from the Mexican National Banking and Securities Commission (CNBV) to become an official bank, the first SOFIPO (People's Finance Corporation) to do so, clearing a major hurdle toward offering payroll accounts and deeper product capabilities. In Colombia, the numbers are smaller, around 2 million customers, but the market is young, underbanked, and growing fast. Together, this shows Nubank isn’t just a Brazilian story, it’s a regional one.

Brazil has engineered a rare combination: public infrastructure that is open and efficient combined with private players that are innovative and fast-moving. The result is a structurally cheaper, more inclusive banking system with ample room to monetize through credit, insurance and investment products. For global investors used to thinking of Latin America’s financial sector as an old fashioned and over concentrated market, Brazil’s story today reads very differently and the spillover effect for the region is already ongoing: Brazil is now exporting not just soybeans and iron ore, but financial architecture.

Graph 1: Brazil’s Credit Card Industry Market Share (%)

Source: Itaú BBA, “Brazil Banks in Context”. January 14, 2025.

Graph 2: Brazil – Number of Transactions (Billions) PIX vs Cards

Source: Banco Central do Brasil (BCB)

LarrainVial Asset Management

LarrainVial S.A. LarrainVial Chile. Isidora Goyenechea 2800, 15th Floor, Las Condes, Santiago, Chile.

Tel.: +562 2339 8500Teléfono: +562 2339 8500

All Rights Reserved ©Copyright 2025