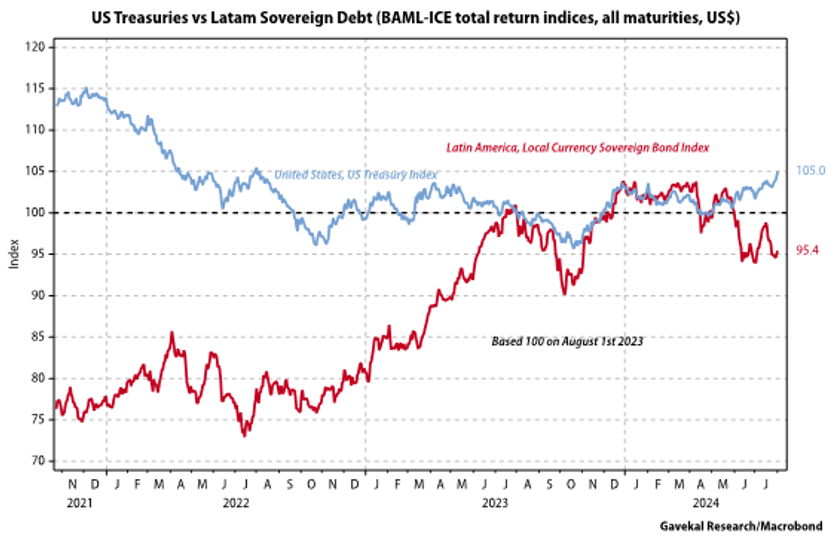

The LarrainVial Gavekal Latam Local Currency Debt Fund has just celebrated its first year. And there is much to celebrate. Firstly, the fund outperformed its benchmark of reference(*); a testimony to the hard work of Alexandre and Gonzalo, the two co-PMs of the strategy. Secondly, and thanks to the terrific support of a number of investors, the fund has raised some US$80m.This support from clients means that the fund is commercially viable. Against that, the one darker cloud in this first year has been the relatively poor performance of Latin American Debt markets, especially in recent weeks. Indeed, coming into the launch of the fund on August 1st, 2023, Latin American local currency debt had been delivering cracking returns. Then, from August 2023 to March 2024, Latin American debt essentially delivered the same performance as US Treasuries, if with a higher volatility. However, starting in March, Latin American debt pulled back aggressively, even as US Treasuries, for several reasons. (*) Return net fees as of 31-07-2024

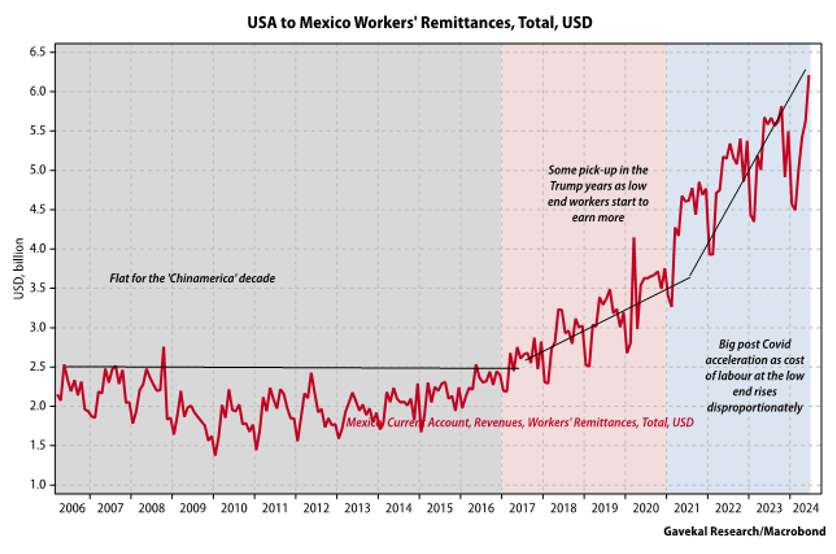

The first shock to Latin American debt markets came from Brazil. When President Lula fired the CEO and CFO of Petrobras, it triggered a high level of anxiety amongst foreign and domestic investors for whom the previous pillaging of the Brazilian oil giant remains an open wound. Lula’s intervention in the running of Petrobras also fed into fears that the Brazilian president intended to have a much more interventionist stance on the Brazilian economy. In consequence, all Brazilian assets, including the currency, sold off. The second shock to the system came from Mexico, where president-elect Claudia Sheinbaum, and her Morena party, did much better in elections than the markets initially anticipated. Suddenly, the market feared that the left-leaning president, and her party, would be able to run roughshod over parliament and increase regulations, increase taxes, perhaps nationalize key assets, blow out budget deficits etc… The Mexican Peso and Mexican assets duly fell.

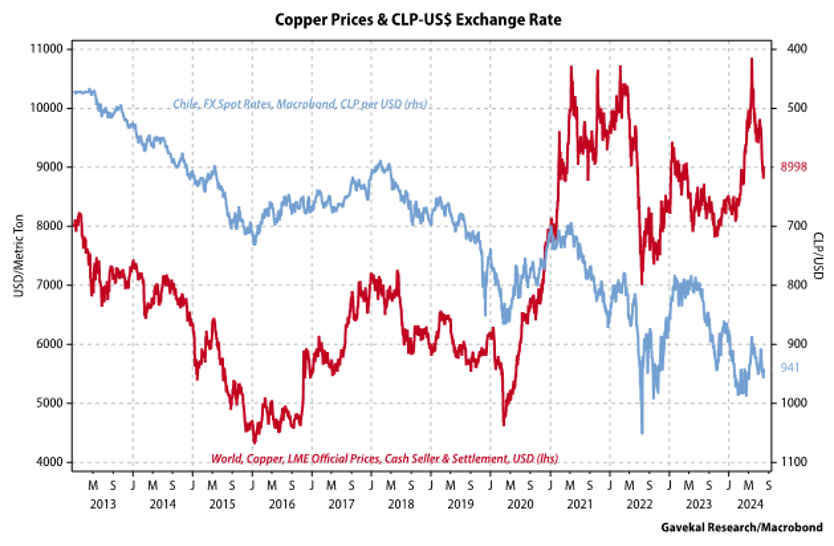

The third shock to Latin American debt and currency markets was the sudden sharp roll-over in a number of commodities, not least of which copper. Part of the reason for the roll-over in commodity prices were disappointing economic data points out of China, and a Third Plenum that left investors underwhelmed. Copper fell from close to US$11k per metric-ton in mid-May to less than US$9000/metric-ton today. Copper is of course a key export for Chile and Peru and historically, the CLP is often impacted by fluctuations in the metal’s price. And sure enough, as copper prices rolled over, so did the Chilean Peso:

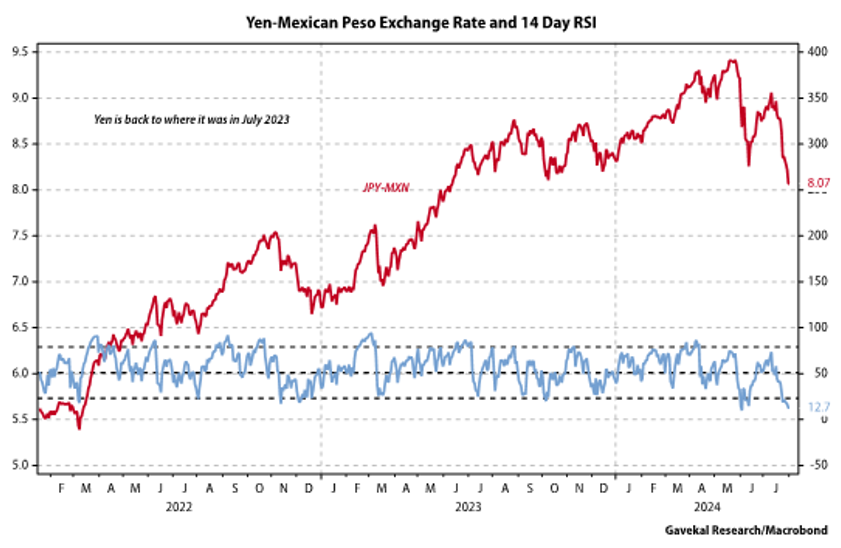

Finally, the last shock, one that is unfolding as we write, is the squeeze in all the Yen carry trades. Indeed, in the past few weeks, the Japanese Yen has rebounded very strongly. This means that Japanese investors who, until now, had felt comfortable buying Mexican and Brazilian bonds, and delighted in the higher yields, suddenly find themselves looking at months of accumulated gains disappear in seconds. In just a few trading sessions, the Yen has rallied back to where it stood in July 2023. One year’s worth of FX gains obliterated in a few trading sessions. This has most likely triggered some margin calls and forced some speculators to cover positions.

So, does all of the above represent a big enough shift in the local macro picture? Or is this a good ‘dip to buy’? Unsurprisingly, we will argue the latter, for the following reasons:

Beyond the region’s behemoths also lie a number of smaller countries, or smaller issuers, who today are doing a terrific job keeping their domestic finances on a steady path and being rewarded for it by debt re-ratings. This is the case of Paraguay, of Uruguay, of Costa Rica, of the Dominican Republic… Of course, these countries do not capture the media attention of an Argentina, or a Venezuela, both massive countries with so much potential that have been tragically mismanaged in the recent decades. But the fund maintains hefty positions in the above countries as their returns tend to be uncorrelated and the yield capture remains more than attractive.

In short, the region remains awash with opportunities and perhaps the one comforting development of the past year has been how many regional issuers have been able to blaze their own trail, and deliver steady returns, even as the region’s behemoths such as Mexico and Brazil temporarily hit the skids. This is a great sign for the future. Having the ability to build genuinely diversified portfolios across the region should make the coming years ever more interesting for both (rapidly growing) domestic capital, as well as foreign investors.

Louis-Vincent Gave

CEO & Founding Partner Gavekal

Member of the Investment committee of the Fund

LarrainVial S.A. LarrainVial Chile. Isidora Goyenechea 2800, 15th Floor, Las Condes, Santiago, Chile.

Tel.: +562 2339 8500Teléfono: +562 2339 8500

All Rights Reserved ©Copyright 2025