On October 2, 2025, S&P Global Ratings affirmed the “AMP-1” (VERY STRONG) ranking on LarrainVial Asset Management Administradora General de Fondos S.A. (LVAM).

The "AMP-1" (VERY STRONG) ranking on LVAM reflects its strong business profile, as one of the leading independent mutual fund and investment managers in Chile, with a well-diversified portfolio of products for a broad client base, covering different risk and return levels. LVAM currently manages 31 mutual funds, 27 investment funds, and 13 funds abroad, including six SICAV funds in Luxembourg and seven funds in the Cayman Islands.

The ranking also incorporates that LVAM is part of the fund management business unit of Larraín Vial SpA. (not rated), one of the most diversified financial services companies in Chile, which has operations in investment banking, stockbrokerage, and asset management businesses. Asset management continues to be an important activity for the group's (Larraín Vial SpA) expansion plans, while the commercial synergy between the group's entities and LVAM supports the asset manager's business growth, particularly in the private banking sector. On the other hand, LVAM benefits from access to a broad client base through Consorcio Financiero S.A. (not rated), a minority shareholder in the asset management company.

We also believe the entity’s business outside Chile, which includes its offering of international funds and offshore platforms, along with the share of foreign clients exposed to different economic cycles, provides a competitive advantage for the brokerage firm. In this regard, as of the end of August 2025, assets under management (AUM) from abroad represented approximately 37% of total AUM, compared to 32% reported as of July 31, 2024. These results were supported by the consolidation of its existing strategic commercial alliances, focused on the development and distribution of international products. Also, since early 2024, the LarrainVial Group has been a minority shareholder in the Edinburgh and London-based asset manager Aubrey Capital Management, whose investments focus on emerging market equities. We believe this will support the growth of LVAM's business abroad. We anticipate that international business will be one of the main growth drivers for the asset manager in the coming years.

At the end of August 2025, LVAM's market share was 5.5%, making it the sixth-largest asset manager in the Chilean market, with AUM of CLP6,619 billion (equivalent to approximately US$6.9 billion). AUM includes mutual funds and investment funds in Chile, along with open-ended investment companies (SICAV funds).

LVAM still faces the challenge of continuing to grow outside of Chile and consolidating the relative performance of its funds compared to its peers and benchmarks in the country's highly competitive environment. The interest rate cuts, and the depreciation of the dollar have led to a greater preference among investors for Latin American fixed-income, variable-income, and balanced mutual funds, to the detriment of fixed-term or money market funds, which has favored LVAM’s growth. However, the most recognized bank asset managers maintain more than 50% of the market share and AUM thanks to their robust sales force and commercial synergies.

The ranking also considers the challenges the industry faces, stemming from the political and economic uncertainty in Chile ahead of the upcoming presidential elections. Consensus in Congress is crucial for the approval of significant policies and reforms to boost economic growth, create jobs, and combat crime in the country. In our opinion, the pension reform, approved in early 2025, which increases employer contributions and maintains pension fund managers as key players in the system, is positive for the market. However, the changes will be implemented gradually, and the asset allocation rules have not yet been defined, so we do not expect significant changes in the asset management business in the short term.

In addition, the ranking reflects that LVAM has a highly experienced management team with a proven track record in the financial asset management market, which contributes to its growth and development. The entity's Board of Directors is composed of nine members, five of whom are independent, which strengthens the decision-making and oversight process. LVAM has a clear corporate strategy, with a greater focus on products that offer higher profitability for its clients and diversification alternatives in foreign currency and/or international assets, in addition to very solid practices in terms of controls and operations.

We believe the entity’s investment management process is well-structured, with segregation of duties between asset management and business areas, which avoids conflicts of interest. Risk management practices are very strong and continue to be consolidated in a centralized structure for all asset management units of LarrainVial group, in addition to its sound fiduciary principles.

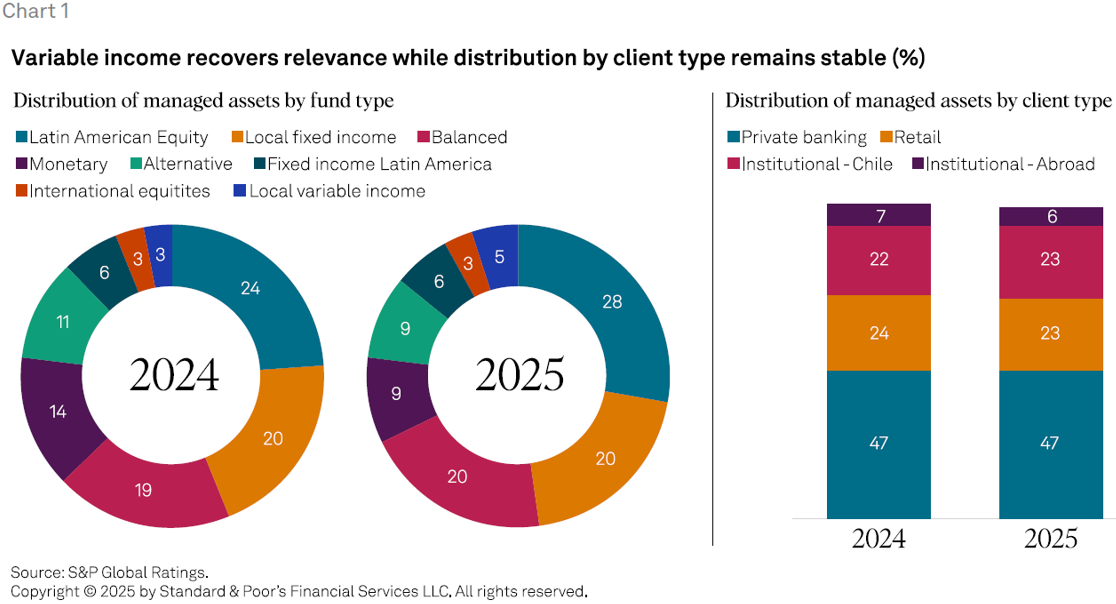

The company continued to show good diversification by asset class, with a greater share of equity funds, driven primarily by an interest rate reduction in Chile.

LVAM's client portfolio primarily has retail investors, which provides greater stability to the assets under management. These investors include voluntary pension savings and retail investors, which together represent 24%, and high-net-worth investors, approximately 47% of assets under management.

LVAM has a strong financial profile, based on its consistent strategy and resources (administrative, technological, and commercial). This supports its sound third-party asset management practices, which allows the entity to have the resources to maintain and continue investing in improving its systems, processes, and internal controls.

As of the end of August 2025, the company's results reached CLP7.39 billion, 24.7% higher than in the same period in 2024. The improved results were primarily due to an increase in recurring revenue, thanks to higher AUM, despite the downward trend in average fees in recent years. This increase is mainly due to performance fees for equity and fixed-income funds, as well as balanced funds. On the other hand, administrative and distribution expenses partially offset the growth in revenue, as part of the revenue is indexed to inflation, primarily salaries, and the other part is dollar-denominated following the company's strategy of growing outside of Chile. We expect that, by the end of 2025, recurring revenue will continue to benefit the asset manager's results, supported by assets under management growth.

LVAM's strategic vision seeks to establish the organization as a benchmark in asset management segment in Latin America, while maintaining transparency and ethical practices in all its management-related activities. The company continues to develop products that are more attractive to the international market, with a medium- to long-term strategy of becoming a benchmark not only in Latin America but in emerging markets in general.

We believe the asset manager has robust risk management and clear investment processes. LVAM's operational structure is in line with international practices in terms of segregation of activities. The asset manager has a healthy organizational structure and adequate human resources to achieve its strategic objectives.

LVAM follows clear guidelines for portfolio composition. The investment process is robust and has a well-defined investment philosophy for each of its strategies and follows a responsible investment policy. We believe the company has a thorough and standardized investment process, based on formalized committees, which meet regularly to assess business performance, investment strategies, risk management, and product performance. It is important to note that the formalization of these committees does not slow down decision-making for portfolio management.

Very strong and well-defined control structure is appropriate for the size of its operations. The asset manager's policies and procedures are well defined and documented. LVAM's risk management process is well structured and uses adequate tools for risk assessment. Risk management continues to play a central role in the investment decision making process, along with emphasis on credit, market, and liquidity risk controls. In recent years, despite various impacts on the industry, such as social unrest, the pandemic, and subsequent pension fund withdrawals, LVAM has maintained prudent liquidity management for its funds.

Also, the asset manager has an independent compliance unit responsible for guaranteeing the integrity and transparency of the asset management processes in adhering to internal and regulatory rules. Likewise, this area operates centrally and in conjunction with the respective control areas of the group's asset management units, which allows it to achieve greater efficiency and specialization, with centralized management of operational risk and alternative risks, along with the centralization of technological developments.

Finally, LVAM constantly invests in new technologies and in the continuous improvement of its processes and controls, with the goal of maintaining its market leadership. We also believe the company has a clear contingency and business continuity plan, which operated without major issues during the social unrest of late 2019 and the pandemic.

Notes:

• The 'AMP-1' rating assigned by S&P Global Ratings represents 'Very Strong' third-party resource management practices within the AMP scale, which ranges from the highest category 'AMP-1' (Very Strong) to the lowest 'AMP-5' (Weak).

• A Third-Party Asset Management Practices Rating ("AMP") is an opinion from S&P Global Ratings on the overall quality of an asset management company. Key components of the analysis include the company's profile and financial situation, the depth and quality of the human and technological resources dedicated to the investment management process, the risk management systems used, and other fiduciary, operational, and control aspects.

LarrainVial S.A. LarrainVial Chile. Isidora Goyenechea 2800, 15th Floor, Las Condes, Santiago, Chile.

Tel.: +562 2339 8500Teléfono: +562 2339 8500

All Rights Reserved ©Copyright 2025